Foreign assets held by Canadian banks overview document

Foreign assets held by Canadian banks overview document (2).pdf

Mark Sibthorpe

Canadian banks, apart from the Big 5, have generally avoided foreign diversification. All of the Big 5 have a significant foreign presence, however, RBC’s massive diversifactation ($1.86T foreign assets, 37% revenue) eclipses its rivals. Whereas, National Bank has also proven highly competitive, despite its domestic focus.

Methodology

This document looks at 4 categories of Canadian banks via charts. The charts are derived from OSFI data which provides details with respect to foreign operations held by Canada’s domestic banks. I have categorized them as Small/Medium, Mid-Tier, Large and Big 5.

The purpose is to provide a snapshot on foreign diversification and to demonstrate how banks have benefited from diversification. I summarize the how, why and where for each of the banks that met the criteria, and to determine the impact on revenue and risk management.

Part 2: The Merchant Loyalty Industrial Complex Collapse

Credit_cards_Part_2v4.pdf

Mark Sibthorpe

Since November 2, 2021, Loyalty Ventures Inc.'s (Airmiles) market cap has decreased from $861.42M to $2.11M, a decrease of -99.75%. This compares closely to 2018, when Aimia sold Aeroplan back to Air Canada and partners TD and CIBC for $238 million. For reference, in 2005 Aeroplan launched an IPO valuing it at $2 billion. Related to Aimia’s downfall, it had also previously sold the UK Nectar program to Sainsburys for $120 million, $580 million lower than it paid for Nectar in 2007.

This report digs under the surface and uncovers why loyalty is going the way of the dodo.

Merchants should not waste time fighting card networks

Card_fees_ongoing.pdf

Mark Sibthorpe

This is part one of a two part assessment of merchant frustration due to high credit card fees. The second part of this report will outline an alternative approach that merchants can consider. An approach that is a win for them and also for the card networks.

The full story of SVB March 12th, 2023

SVB_special_report2.pdf

Mark Sibthorpe

Aggregated news and research related to SVB. Apart from SVB, included in this report is related news with respect to other banks and non-traditional companies looking to add financial services that also appear risky.

March 2023 bank earnings summary

bankearningsfriday.pdf

Mark Sibthorpe

This report provides a snapshot into recent bank earnings and related news as published in fsim.ca reports.

Real estate report: October 30th, 2020

Oct30rereportv1.pdf

Mark Sibthorpe

The big buzz in real estate recently is Mark Carney being scooped up by Brookfield. This means more juice for riskier borrowers. Brookfield, a huge player in real estate, both residential and commercial, recently bought its remaining shares from Sagen (Genworth MI Canada), which values the company at $3.8 bn.

VersaBank’s New High-Security VPN Proving Especially Valuable During COVID-19 Pandemic

TailscaleReleaseMarch30FINAL.pdf

Press Release

VersaBank (TSX:VB) (“VB” or the “Bank”) today announced the implementation of its new high security Virtual Private Network (VPN) remote access software solution, developed in partnership with Tailscale, a leading provider of secure network connectivity solutions. The software enables VersaBank employees to securely and directly connect to all the Bank’s servers across multiple offices and cloud providers, using two factor authentication and with every connection encrypted. The Tailscale-based solution uses the Office 365 setup and Windows client/server applications that the Bank already had in place.

2014 FSIM when Bernanke visited Montreal

MockBernanke.pdf

Mark Sibthorpe

Considering Bernanke is hated by the Republicans and hated even more by the Democrats, and is currently under scrutiny for saving AIG but not Lehman, (in hindsight) with respect to issues over solvency vs liquidity, the Montreal lovefest attended by 1,100 people yesterday must have been a welcome respite. Click the link to read the entire 2014 report.

Eisman's big Canadian bank short

eisman2.pdf

Mark Sibthorpe

I have been reporting on Steve Eisman's short position for quite some time. As the analyst reaction to Eisman shows (link below), Eisman has taken a lot of heat for shorting Canadian banks. Instead of capitulating, in September 2019 he publicly disclosed the fact that he added Canadian Tire to his position, He explains the rationale for this in a BNN interview late 2019. Essentially, his big concern with respect to banks was non-performing loans in Alberta. He feels Canadian bank CEOs are not prepared for a credit cycle. He specifically referenced ATB (a private bank) in discussing his concerns. Looking at the numbers today, my guess is that he has made off like a bandit.

VersaBank Beta-Testing Its New, High Volume Mortgage Finance App

VBCortelMortFinanceAppFeb62020.pdf

Press Release

VersaBank announces it is initiating beta-testing on its newly developed high-volume mortgage software app with the Cortel Group, one of Canada’s largest home and condominium builders. The app, named “Direct Connect”, was designed to facilitate and significantly reduce the lengthy finance approval process typically experienced by home buyers when visiting home and condo pre-construction sales offices.

How and why you need to defend your brand against disruptors

Mark Sibthorpe

Technology, and being open to opportunities, has preempted transformation in banking. At the top of change are Mint, PayPal and ApplePay; three examples of transformative solutions that are now ubiquitous. On the horizon: Uber and Google, both having recently announced partner based banking services. Further down in the plumbing is Duca Impact Labs, Versabank, and Revolut. This report shows how cost conscious FIs can, not only stay relevant in the face of adversity, but punch well above their weight. All thanks to creative thinking and the ongoing commoditization of technology.

Kick the can(nomics)

Kick.pdf

Mark Sibthorpe

Canada has used consumer debt to provide life support to the economy. This strategy which basically pushed the day of reckoning to the next government was old back in 2014, and now is well past its sell-by-date. Recognizing this, and desperate to keep the economy out of a recession, Trudeau is spending more money now than any government in Canadian history. This report disusses a possible alternative.

ScoreCard Bill Morneau, Canada's Minister of Finance

ScoreCardMorneau.pdf

Mark Sibthorpe

This report is a scorecard I designed in order to rank the performance of the current Minister of Finance, Bill Morneau. I do regular rankings because, otherwise, I cannot measure the performance in a meaningful way. The scoring is based on a variety of metrics as detailed on the ‘score-table’ on page 3. Examples of the criteria and weighting include:

Observations and overview of 2018 NB flood support from government and insurance companies.

Observations and overview of 2018 NB flood support from government and insurance companies..pdf

Mark Sibthorpe

Flood aftermath is linked to post traumatic stress. Here are some findings from a study conducted by Queensland University following a flood:

"The findings showed that aftermath stress contributed to poor mental health outcomes over and above the flood itself, prior mental health issues and demographic factors," Ms Dixon said.

"Aftermath stress was the strongest predictor of post-traumatic stress symptoms with 75 per cent of people saying the most difficult aspect was the aftermath and dealing with insurance companies," she said.

With this in mind, I felt it was important to understand how New Brunswick flood victims were treated.

Update Argentina: a sign of the times

Update Argentina_ a sign of the times.pdf

Mark Sibthorpe

Argentina is in the news daily because the situation is dire, and may be an indication of further contagion. The most dramatic story that speaks of the a leading cause of its troubles was the recent arrest of the public works secretary, Jose Lopez. June 15th he was caught hiding millions in cash in a monastery. No this is not a plot for a comedy.

Summary of Canada's flood news, 2017 to present

Summary-of-flood-news-2017-present.pdf

Mark Sibthorpe

This report covers flood news in Canada from 2017 to present and highlights the relevent issues for home-owners and the insurance industry.

Banking on Pot

c10191_banking-on-pot.pdf

SBS

As states across the US legalize marijuana for both medicinal and recreational purposes, it has fueled a growing industry of marijuana related businesses (MRBs).

Canadian banking industry overview

Mark Sibthorpe

2014 Mobile payments the Apple pay way

Mobile_Payments_Apple_Pay_2014.pdf

Mark Sibthorpe

With Walmart Pay about to userp Apple Pay, I thought I would share my 2014 book on mobile payments and loyalty. The guilde was written for Merchants that want to understand loyalty, credit, mobile payments and Apple Pay, but anyone involved with credit and loyalty might find it useful.

The book is a prelude to Walmart leaving MCX, and chronicles the evolution that led to Walmart Pay. There is an extensive case study of Walmart that looks into its efforts to become an ILC and to avoid paying credit card transaction fees ('merchant discount').

It offers readers a step-by-step methodology for evaluating and transforming credit and loyalty programs. The strategies are based on proven examples and industry facts. The Nectar, Target, Canadian Tire and Walmart case studies are examples of the practical approach I have taken, written with the intent that merchants can use them as blueprints for their own initiatives.

Death to bitcoin, long live the blockchain

Mark Sibthorpe

Jamie Dimon calls bitcoin a fraud used by criminals, yet he has jumped into the blockchain with both feet.

TD bank industry conduct

tdind2.pdf

Mark Sibthorpe

TD’s share price recently collapsed by $7 bn in one day due to CBC’s allegations of aggressive selling tactics. A huge fall from a bank that was trading at a premium as recently as January. This was even before the most recent allegation of TD attempting to

avoid paying taxes on advertising.

This report chronicles the events leading up to the collapse, shows TD's performance, analyses other related issues.

Book review: Back from the Brink

backbrink.pdf

Mark Sibthorpe

This is a book review of the book Back from the Brink by Paul Halpern, Caroline Cakebread, Christopher C. Nicholls and Poonam Puri.

Footnote 151

footnote151.pdf

Mark Sibthorpe

Footnote 151 implies an important regulatory change related to derivative contracts. It means that US Banks will not be required to hold as much capital against commodities. If you want to understand the implications of this regulatory change in more detail, see the enclosed related article detailing the changes. For contextual purposes, I have also included two Rolling Stones Magazines reports from

2010 and

2014 that chronicle the role large US banks have played in manipulating commodities. You might question the credibility of these sources, but rest assured, these reports are based on

United States Senate hearings which outline the issues in a

396 page report related to the implied risks.

Save the Canadian economy now

helecopter-money.pdf

Mark Sibthorpe

Consumer debt spending appears to have insulated Canada from the worst of the credit crisis, but now the alarming magnitude of consumer debt ($1.92-trillion) could exacerbate a day of reckoning.

This report assesses the issues at hand and recommends the solution to get Canada's economy on track.

Reasons financial service companies should consider gamification

GamingEventProposal-printsample--en-final.pdf

Mark Sibthorpe

Gamification of business processes resulted on Mint.com growing to 10 million users within 4 years. This report explains how.

National Bank Special Report

NatBSpec.pdf

Mark Sibthorpe

According to Bloomberg, National Bank of Canada will take a C$64 million ($48 million) restructuring charge in the fourth quarter and said its investment in Maple Financial Group Inc., which is being probed by German regulators, may be at risk of a “substantial loss.”

Will Canadian banks charge companies for deposits?

depgrowthimpact2.pdf

Mark Sibthorpe

In light of today’s possible rate cut, this report discusses how a bank rate cut and capital ratio pressure could precipitate negative corporate deposit interest rates in Canada.

Canadian Tire's (CTC) - Canadian Tire Financial Services (CTFS) Scotia deal overview and risk assess

ctfsfinal.pdf

Mark Sibthorpe

Review of the Canadian Tire Financial Services deal with Scotiabank, risks, opportunity and benefits.

Finance minisiter scorecard August 26, 2015

Scorejo-August-2015.pdf

Mark Sibthorpe

This report looks at Joe Oliver, minister of finance’s progress to date, and assigns a grade to his government’s performance to date.

Xtreme Branch

xbranch.pdf

Mark Sibthorpe

Branches are evolving to meet the digital age. This documents tracks the evolution with real-world examples.

Canadian Nudge

nudge.pdf

Mark Sibthorpe

Whether he knew it or not, Tom Reid, a senior vice-president at Sun Life, made a case for the behavior modification concept ‘Nudging’ when he recently proposed auto-enrolling Canadians in his company’s pension plans. Sun life cover 1.2 million Canadians, about 60% of the eligible employees.

According to Reid,

CWB cause for concern

cwbupdate.pdf

Mark Sibthorpe

In an earlier report BankNews.TV expressed concerns about CWB. Here are 5 charts that show cause:

1. First earnings drop in years;

2. Deposits dropping which will increase cost of funds in the future.

BNTV Overview

overviewpdf.pdf

BNTV

BankNews.TV Publishing Corp services overview document:

-

Analytics

-

Financial services industry monitor (FSIM) industry briefings and developments reports

-

Research

Challenger banks not a threat to big banks

challenger.pdf

Mark Sibthorpe

This report looks at Canadian challenger banks (apart from merchant led banks) and explains why they have not threatened larger institutions. It also looks at ways in which these upstarts have achieved success.

The impact a rate rise will have for Canadian banks

irr-f.pdf

Mark Sibthorpe

Canadian banks have made money throughout the credit crisis, but this trend may be about to reverse. The rational supporting this prediction is that revenue has grown despite a declining net interest margin (NIM). It has grown in spite of this fact because Canadian debt (loan lease volume) has risen significantly, as shown in chart 2.

This report looks at the issues facing Canadian banks in the event of a Bank Rate rise.

FIFA: the new goldenballs

goldenballs.pdf

Mark Sibthorpe

Yesterday, the Attorney General of Switzerland (OAG) opened criminal proceedings related to the FIFA scandal. This report outlines some of the events related to the criminal investigation, with a particular focus on banking.

Scorecard Minister of Finance: JIm Flaherty

Scorecard Min Fin Flaherty April 8 2014.pdf

Mark Sibthorpe

March 18, Finance Minister Jim Flaherty resigned from cabinet after having endured a difficult year due to health issues. This report looks at his legacy and attempts to grade his government’s performance to date.

Merchants extend financial services

merchantfs.pdf

Mark Sibthorpe

Merchant led financial services are growing in importance once again. This is exemplified in the ongoing UK rivalry between ASDA, Sainsbury and Tesco. Together these merchant/financial service companies provide the backstop for three different approaches for merchants looking to extend their financial services.

Hot Money: real-estate

hotmoney.pdf

Mark Sibthorpe

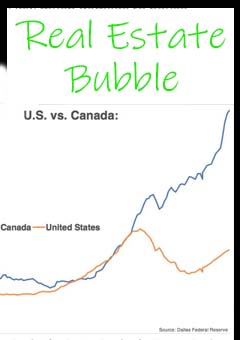

Canadian and London real estate, like Macau, may also be a convenient means for China’s elite to move money offshore; with the deleterious effect of driving up home values. Louise Shelley`s research concurs. In a published paper written for the National Defense University, Shelley argues that money laundering in real estate (MLRE) increases prices.

Currency Cheat Sheet: a guide for the rest of us

currencycheatsheet.pdf

Mark Sibthorpe

Readers of this document will be presented with monetary policy issues and facts

that show the USD will likely remain the dominant reserve currency, despite

questionable Chinese practices, record US debt levels, and a shaky economy.

Riches to Rags? Summary of possible risks for Genworth MI CANADA, INC.

gq4risk.pdf

Mark Sibthorpe

Genworth had its Q4 2014 earnings call. Genworth own about 30% of the mortgage default insurance in Canada. Not surprisingly, the earnings call became focussed on Alberta; and for good reason, with 20% of its outstanding insured mortgage balance in Alberta, sensitivity to the oil shock and how Genworth plan to manage related risks were discussed in detail.

Canadian Western Bank Competitive Forecast

cwbf.pdf

Mark Sibthorpe

Based on historical financial data (see detailed charts pages 5-8), the oil based recession in Alberta, and comparison against two of its peers, this document outlines my observation with respect to CWB’s future performances.

Liquid Canada: the tipping point

Liquid.pdf

Mark Sibthorpe

This report examines liquidity issues in the Canadian financial service industry.

Bank Fees

Bank fees.pdf

Mark Sibthorpe

Recently the

CBC and The

Globe and Mail both reported on what has been referred to as a consumer “bank fee outcry”. CBC compares banks to cable and phone companies, standing accused of trying to gouge customers with service fees. The backlash appears to have originated in conjunction with the NDP and the Consumers Council of Canada which argues that there is anxiety ‘among consumers about banking fees’.

Cheap Oil Report

co2.pdf

Cheap oil has pushed the Bank of Canada's governor, Stephen Poloz onto a slippery slope. For some background on this, take October 22nd, when Poloz bid farewell to forward guidance, resulting in yesterday's surprise rate cut. A cut that has enraged TD and other banks, which see this as eroding profits.

Canada's Economy, a strategic solution

ces.pdf

This report explores Canada's strategies to compete globally. The report begins with an analyses of the housing market, because housing is the canary in the coal mine; explores what happens in the event of collapse; and analyses the underlying problem causing Canada to be uncompetitive.

Mobile Payments Blueprint: guide to credit and loyalty transformation for merchants

booksample.pdf

Merchants that want to understand loyalty, credit and mobile payments should read this book. It offers readers a step-by-step methodology for evaluating and transforming credit and loyalty programs. The strategies are based on proven examples and facts. The Nectar, Target, Canadian Tire and Walmart case studies are examples of the practical approach I have taken, written with the intent that merchants can use them as blueprints for their own initiatives.

Guide to system selection

gssnow.pdf

Read sample report: Guide to system selection. This sample would normally cost $99 but is available free as a sample. Click here view sample report.

Displayed data is for demo purposes.

Login here for full access.

SeekingAlpha (2026-03-09)

In February, Robinhood Markets (HOOD) launched Robinhood Ventures Fund I (RVI), the inaugural fund from its venture arm that aims to give investors exposure to a concentrated portfolio of private companies, including Airwallex, Boom Supersonic, Databricks, Mercor, Oura, Ramp and Revolut (REVOLUT).

Lloyds (2026-03-09)

The US has launched a $20bn government-backed reinsurance facility to keep commercial shipping moving through the Strait of Hormuz after US–Israeli strikes on Iran, but details on eligibility still unclear.

Fortune India (2026-03-09)

Both exporters and insurers appear to be recalibrating risk assumptions.

Pymnts (2026-03-09)

Canada’s trajectory centers on infrastructure transformation paired with regulatory reform.