XE.com explains their Big Data and AI strategy.

Video

Overview

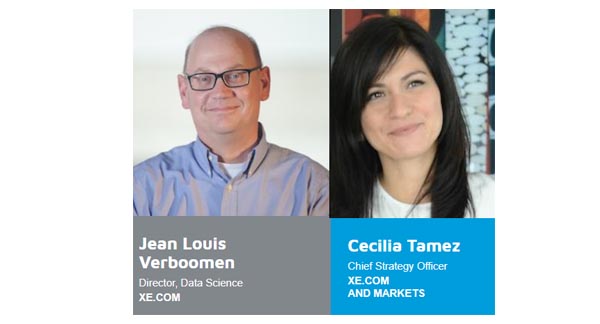

This video covers XE.com's presentation at the AI, Big Data and Analytics event which took place in Toronto February 7/8, 2018. Cecelia Tamez and Jean Louis provide insights into their evolution and winning strategy.

Enhanced Content

This content is synchronized with the video playback:

XE.com share insights

XE.com, a leader in currency exchange.

XE.com have 285 million customers. Their journey, which took over 25 years, has resulted in an event driven strategy that puts the customer in focus.

Appears at 0s - 5sXE.com team

Cecilia Tamez and Jean Louis Verboomen share their insights.

Appears at 5s - 8sComments & Discussion

Login Required: Login here to post comments and participate in discussions.

No comments yet. Be the first to share your thoughts!